Growth Strategy: How to Define Where to Play

- Apr 23, 2024

- 4 min read

In our last post we looked at the right pace of growth or, to say it with Roger Martin’s Playing to Win: What is the winning aspiration? In this post we look at the next question of where to play.

The Total Addressable Market

Already at the business strategy level an organization must define the Total Addressable Market (TAM), the “overall revenue opportunity that is available for a product or service if 100% market share is achieved”.

For this the Business Strategy must describe the demand it plans to address with its offering. In B2B markets this demand stems from Economic Buyers who own budgets. So, to define the TAM a Disruptor must provide criteria for describing the Economic Buyers the organization plans to target. Typical criteria are industry, geography, and company size.

Consequently, the input the organization’s Business Strategy provides for its Growth Strategy must have the following format:

With our Offering the Organization addresses Economic Buyers within Industries in Geographies representing a TAM of X. We aim to increase revenue by Y within the next Z period.

Example: With our suite of Extended Supply Chain solutions ACME addresses Production, Procurement, and Logistics managers within Discrete Manufacturing in Europe representing a TAM of €2B. We aim to increase revenue by 100% within the next 3 years.

TAM Breakdown

The first step in formulating an organization’s Growth Strategy must be the breakdown of the TAM into Target Market Segments (TMS) as a subset of the TAM. Using our above example we could define the German Automotive Industry as a TMS.

Already Addressed TMS

Unless they just entered their first TMS a Disruptor will find a list of TMS they already address. For these they have the following data points informing them about the growth they can expect from further investing resources into them:

Last period’s revenues

Past growth rate

Current resource allocation

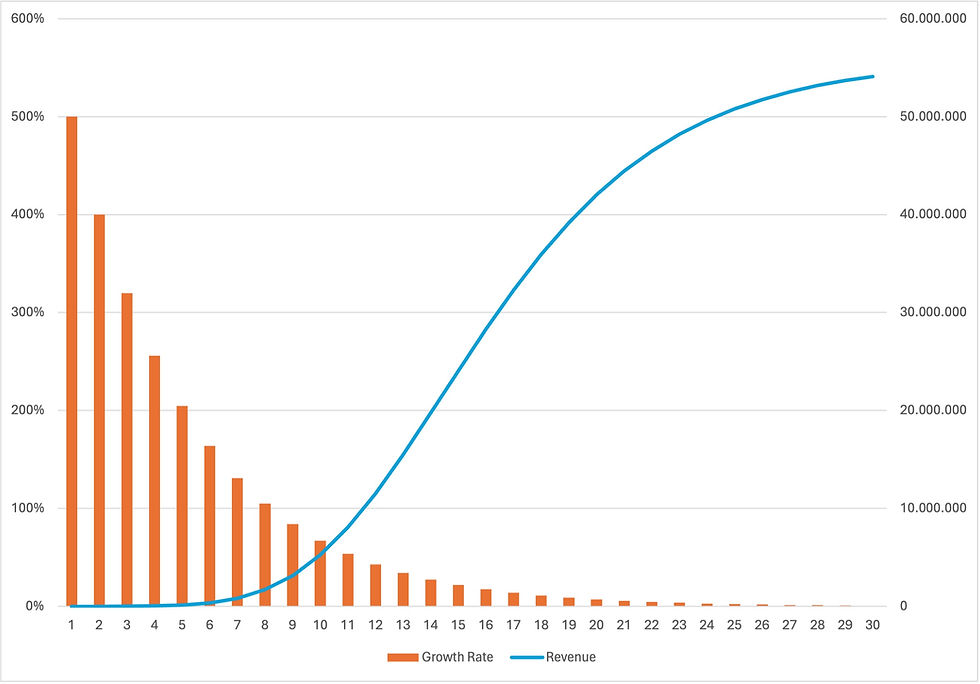

These data points allow the Disruptor to allocate a TMS on its growth curve: After investing into a new TMS they will experience a phase of hypergrowth before the curve flattens out.

Within the Growth Strategy the Disruptor must continue to add resources in the first half of the TMS development, but can stop growing them and ultimately even reduce resources in the second half.

As a result of this exercise the Disruptor understands the growth rate and absolute growth they can expect from already addressed TMS and the required resource allocation.

Added Value

A Disruptor can accelerate the growth rate of already addressed TMS by adding more value to their offering.

This added value can result from providing add-ons supporting the adoption of the Disruptor’s offering, e.g., complimentary products, training, implementation, integration, and support. These add-ons can be provided by the organization itself or 3rd parties.

Selling added value requires upskilling customer-facing resources for communicating a higher value proposition to customers, e.g. move from generic product benefits to individual business outcomes for customers.

New TMS

Entering a new TMS must be a conscious management decision as it requires investment and comes along with risks. A Disruptor enters a new TMS when they change one of the three dimensions describing them: Industry, Geography, and Company Size.

The lower the number of dimensions they change the more a Disruptor can leverage investments in already existing TMS, the lower the risk and vice versa. For example if a Disruptor already sold into the German Automotive Industry they can leverage Sales Campaigns, references, and partnerships for entering the Scandinavian one.

Entering a new TMS is an experiment and, as with all experiments, the faster and the more often a disruptor fails the better their chances of achieving a breakthrough. A Disruptor can hedge their bets by entering multiple new TMS at a time, but they must define clear success criteria to be monitored so they can stop the experiment early when it fails.

Every TMS is characterized by an individual risk/reward profile. Large, mature markets like the German Automotive industry provide significant potential for growth, but come along with high competitive resistance by well established Incumbents. As a consequence, a Disruptor must look at new TMS as a portfolio of investments with different risk/reward profiles.

Entering new TMS requires a longer and larger investment and comes with substantial risk. On the other hand it leverages the existing offering, skill sets, and processes and thus puts less stress on the organization than upgrading to a higher value level.

The number of new TMS a Disruptor can enter is limited by the sales and marketing resources they can assign to them. They can expand resources by leveraging partner capabilities, but this requires the offering to possess Ecosystem Fit.

Summary

The Disruptor’s Growth Strategy must define existing TMS they continue to develop and new TMS they plan to enter. It must define and measure clear success criteria for entering new TMS so management can decide on continuing or suspending the investment into a particular new TMS based on data.

While the Growth Strategy can rely on historic data for existing TMS it must make assumptions regarding the expected revenue growth of new TMS. As a result, the Growth Strategy is based on a combination of deterministic data for existing and heuristic data for new TMS.

The Growth Strategy must balance risks and rewards of existing and new TMS to define ambitious, yet achievable targets for the Sales and Marketing Plan.

Comentarios