Growth Strategy: How Fast Can You Go, How Fast Do You Have to?

- Apr 9, 2024

- 5 min read

“While the usual explanations for slow or minimal growth - market forces and technological changes such as disruptive innovation - play a role, many companies’ growth problems are self-inflicted” Gary P. Pisano, HBR Magazine March-April 2024

To proactively and consistently grow, companies need a Growth Strategy defining how fast to grow, where to grow, and where to allocate the required financial, human, and organizational resources. Today we look at how to determine the growth rate a Disruptor must aim for to capture market share.

Business Strategy

A company’s Business Strategy consists of Technology, Portfolio/Product, and Growth Strategy. It is collectively owned by the entire Executive Board and must reflect expectations from shareholders, customers, business partners, employees, governments, and society. The Business Strategy must describe the organization’s goals and the measures to achieve them on a corporate level.

Following Roger Martin’s Playing to Win any strategy must answer to following questions:

What is the winning aspiration?

Where to play?

How to win?

What capabilities?

What management system?

One of the goals the Business Strategy must define is the desired growth of revenues and margins.

The first limiting factor is market demand. To understand market demand the Business Strategy must specify the product portfolio and the Total Addressable Market (TAM) for this portfolio.

The second limiting factor is the availability of financial, organizational, and external resources required to produce the desired growth. While financial and external resources can be exactly described and quantified, understanding the current organizational capabilities, their scalability, and adaptability to new requirements is much harder.

A company can grow organically via expanding their existing organization, or inorganically via acquisitions.

The Executive Board must correctly assess the organization’s sustainable organic and inorganic growth potential. Shooting for a higher growth rate than an organization can deliver will lead to quality issues and ultimately damage customer experience.

Growth Strategy

The Growth Strategy as part of the Business Strategy is owned by the Chief Revenue Officer (CRO) or, a profile emerging more recently, the Chief Growth Officer.

Besides organic and inorganic growth there are two more distinct types of growth:

Vertical growth happens within a Target Market Segment (TMS) by expanding into a higher value stage to address a bigger portion of customer budgets, e.g. by offering solution bundles combining own and 3rd party products and services to lower adoption barriers for mainstream buyers.

Horizontal growth is achieved by entering new TMS on the existing value stage, e.g. expanding into new geographies or industries.

As a result, the Growth Strategy must determine the combination of organic and inorganic growth with vertical and horizontal growth for every TMS the organization wants to address.

How Fast Can You Go?

The overall growth rate an organization can achieve with a given set of resources results from the growth rate within each TMS the organization decides to address. The baseline growth is given by the growth across all the TMS the organization already entered, the incremental growth is driven by horizontal growth and vertical growth.

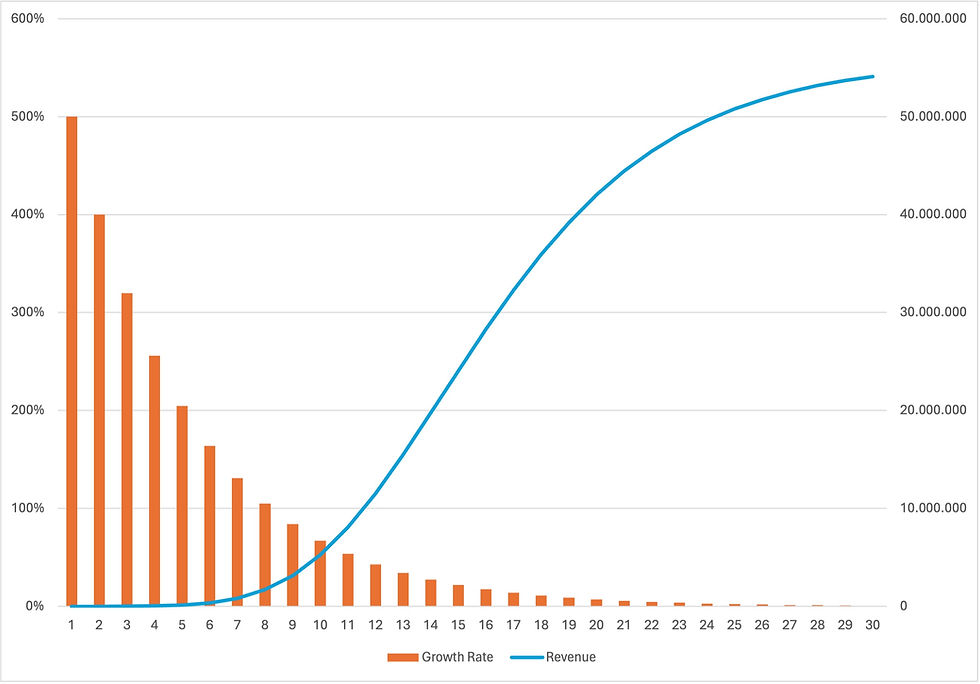

Chart 1 shows the organic revenue growth within a TMS over time. After a slow start required to achieve Go-to-Market Fit within the TMS, revenue enters a period of hypergrowth before it levels out after the mainstream market adopted the new technology. In this example we exit period 30 with revenues of 54M and a growth rate of 1%.

Chart 2 demonstrates the impact of vertical growth by starting to generate a 50% Added Value to an already existing revenue in period 10. In this example we exit period 30 with revenues of 81M (+27M compared to Chart 1) and a growth rate of 1% (+-0 compared to Chart 1).

Chart 3 demonstrates the impact of entering a second TMS over the same period of 30 units. The Total Revenue is the sum of Revenue TMS 1 and TMS 2 where TMS 1 was entered in period 1 and TMS 2 was entered 10 periods later. In this example we exit period 30 with revenues of 99M (+45M compared to Chart 1) and a growth rate of 3% (+2% compared to Chart 1).

Chart 4 demonstrates the impact of combining vertical with horizontal growth. In this example we exit period 30 with revenues of 126M (+72M compared to Chart 1) and a growth rate of 2% (+1 compared to Chart 1).

The 4 charts demonstrate that the Total Growth Rate depends on an organization’s capability to generate added value in existing TMS for vertical growth and entering new TMS for horizontal growth.

Trade-offs

There are a number of trade-offs the Growth Strategy must deal with:

Vertical growth leverages the existing customer base for up- and cross selling and thus provides faster returns. It requires upskilling customer-facing resources for communicating a higher value proposition to customers, e.g. move from generic product benefits to individual business outcomes for customers.

Horizontal growth requires a longer and larger investment into new TMS and comes with substantial risk. On the other hand it leverages the existing offering, skill sets, and processes and thus puts less stress on the organization than vertical growth.

Organic growth takes more time and the growth rate is hence lower compared to inorganic growth. It is less risky as it can be managed in fast iterations of experiments while inorganic growth represents one big experiment. Organic growth doesn’t impact the existing culture and power bases of an organization and hence comes with less tension and friction.

Inorganic growth can immediately establish critical mass on a higher value stage or in a new TMS and thus deliver economies of scale faster. The customer base of an acquired entity delivers immediate revenue streams and provides short-term potential for up- and cross-sell. On the downside, inorganic growth requires a one-way-door decision that cannot be undone without significant losses.

How Fast Do You Have To Grow?

In the long run a company can only win new customers by entering new TMS, not by adding value within existing TMS. As a consequence, a Disruptor must not rely on vertical growth only, but must achieve horizontal growth in order to displace Incumbents and grow their overall market share.

Incumbents, on the other hand, already conquered most of the TMS within their TAM. Their growth is vertical and they can leverage their existing customer base for it.

As a consequence, Disruptors must produce higher horizontal growth than Incumbents grow vertical to take market share away from them.

How fast a Disruptor must grow is a function of the Incumbents' ability to react to the threat they pose to their existing business. In mature markets with a limited set of large Incumbents protected by high market entry barriers Disruptors will enjoy a larger window of opportunity compared to young, dynamic markets with highly agile Incumbents.

We described an example for the former in our post on AWS’ disruption of the Enterprise IT market while today’s AI market provides an example for the latter where large and highly agile players like Microsoft, Google, and AWS quickly react to new developments like the launch of Open AI.

Summary

A growth-oriented organization's incremental growth is limited by its ability to vertically grow in TMS they are already serving and horizontally grow in new TMS. Both vertical and horizontal growth can be amplified by inorganic growth.

The growth a Disruptor must achieve is defined by their competitions' ability to react to the threat via organic or inorganic growth within the TMS they already serve.

A Disruptor whose ability to grow is lower than the rate of growth required to take market share away from Incumbents will ultimately fail.

Comments